What: This article explains the steps for recording invoices so that vendors can get paid in a timely manner.

Who: Treasurer, MonsterCorps, Officers

Why: We need to ensure billing records are stored properly for at least three years and we want to avoid paying vendors late.

Pre-Steps

- Most often, bills are approved by the Executive Director and then sent to the Treasurer via e-mail. If that has occurred, proceed to step 1 below.

- If the Executive Director did not approve an invoice, contact them to ensure the bill is valid.

Paying One Vendor at a Time

Exceptions: Wise, Aaron Baaraza (see below)

- Zapier will ping the accounts-payable channel in Slack when a new bill image has been stored in the Vendors folder. If a bill image is not included in the e-mail, save the entire e-mail thread as a pdf.

- Search the vendor profile in Quickbooks and/or the W9 folder to ensure we have a completed W9 for this vendor. If not, create a task in Asana for the Treasurer to request a W9 from the vendor

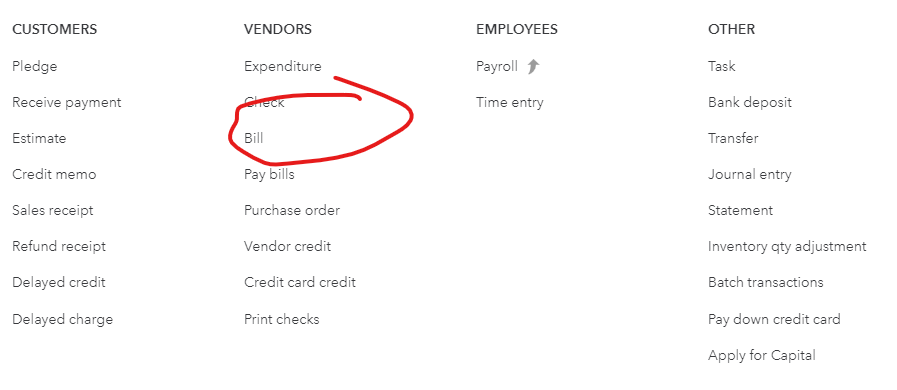

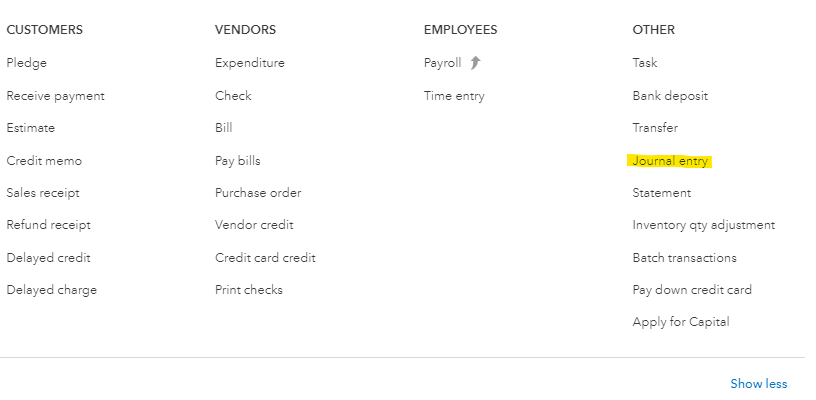

- Create the bill in Quickbooks by clicking the New button in the upper-left corner and then selecting Bill under the Vendors column.

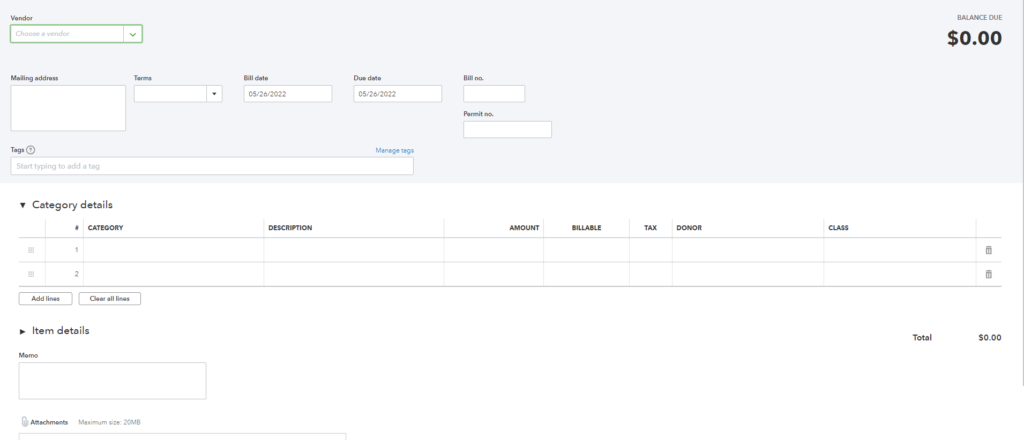

- Once you reach this screen, complete the following fields as follows:

- Vendor – record Vendor name here

- Mailing Address – it’s not necessary to add anything here

- Terms – set at Net 30

- Bill Date – use the date on the bill image or service date. If they are conflicting, choose the earliest.

- Due Date – this field should be automatically updated

- Bill No – use the number or reference ID provided by the vendor. If none, leave this field blank.

- Permit No – leave this field blank

- Tags – leave this field blank

- Category – use guidance from the vendor’s payment and sources or the treasurer’s email to select the correct account code

- Description – use the description from the invoice

- Amount – record the total bill amount

- Billable- leave this field blank

- Tax- leave this field blank

- Donor- leave this field blank

- Class – if the category code begins with a 5, select Program. Otherwise, select Administrative

- Memo – copy the description from the Description above

- Attachment – add the invoice image here

- Save and close. Repeat this until all invoices have been recorded.

Paying Two Parties

When paying vendors outside the U.S., we use a service called Wise. This processes the payment into the required currency and charges us a fee.

- Download the bill image and the Wise receipt and store them in the Vendors folder.

- If a Vendor’s name is not present, create a new folder

- If a bill image is not included in the e-mail, save the entire e-mail thread as a pdf.

- Create the Journal Entry in Quickbooks by clicking the New button in the upper-left corner and selecting Journal Entry under the Other column.

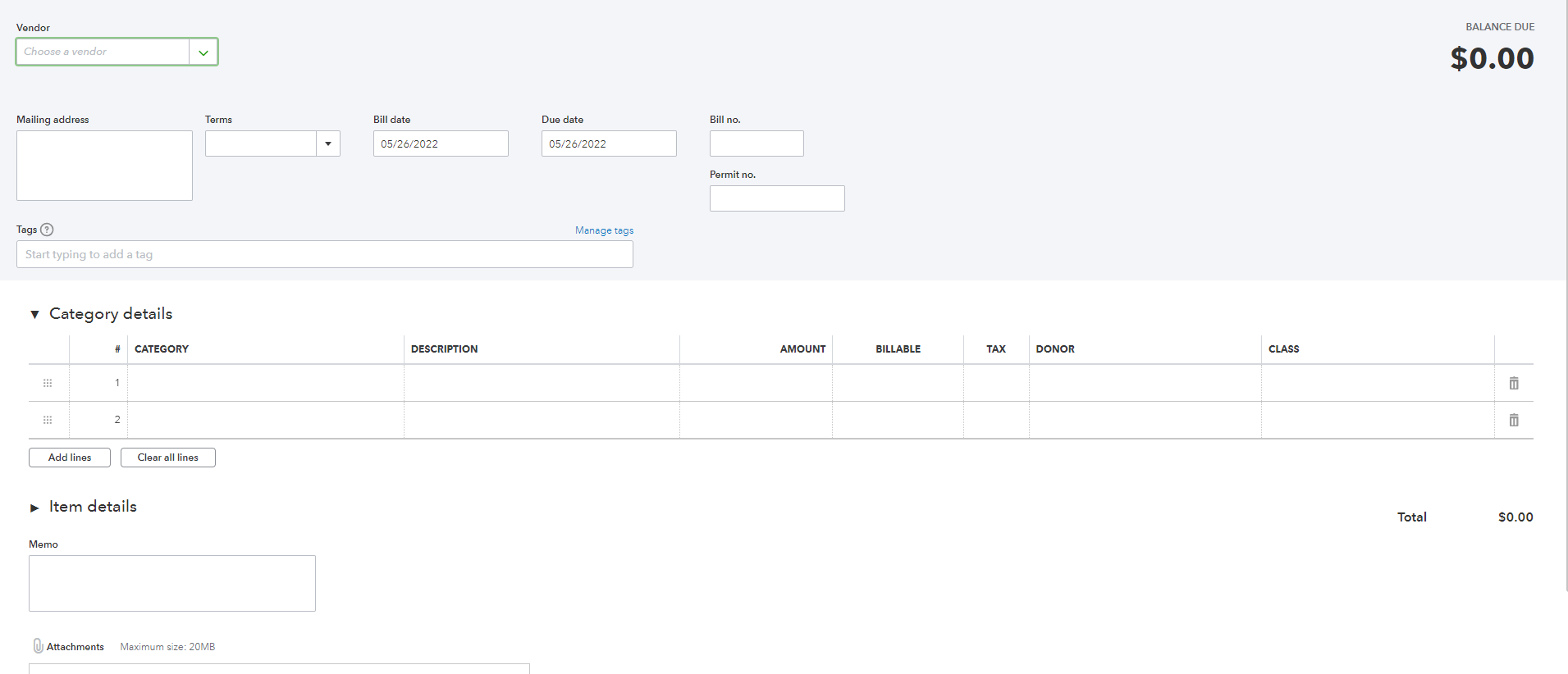

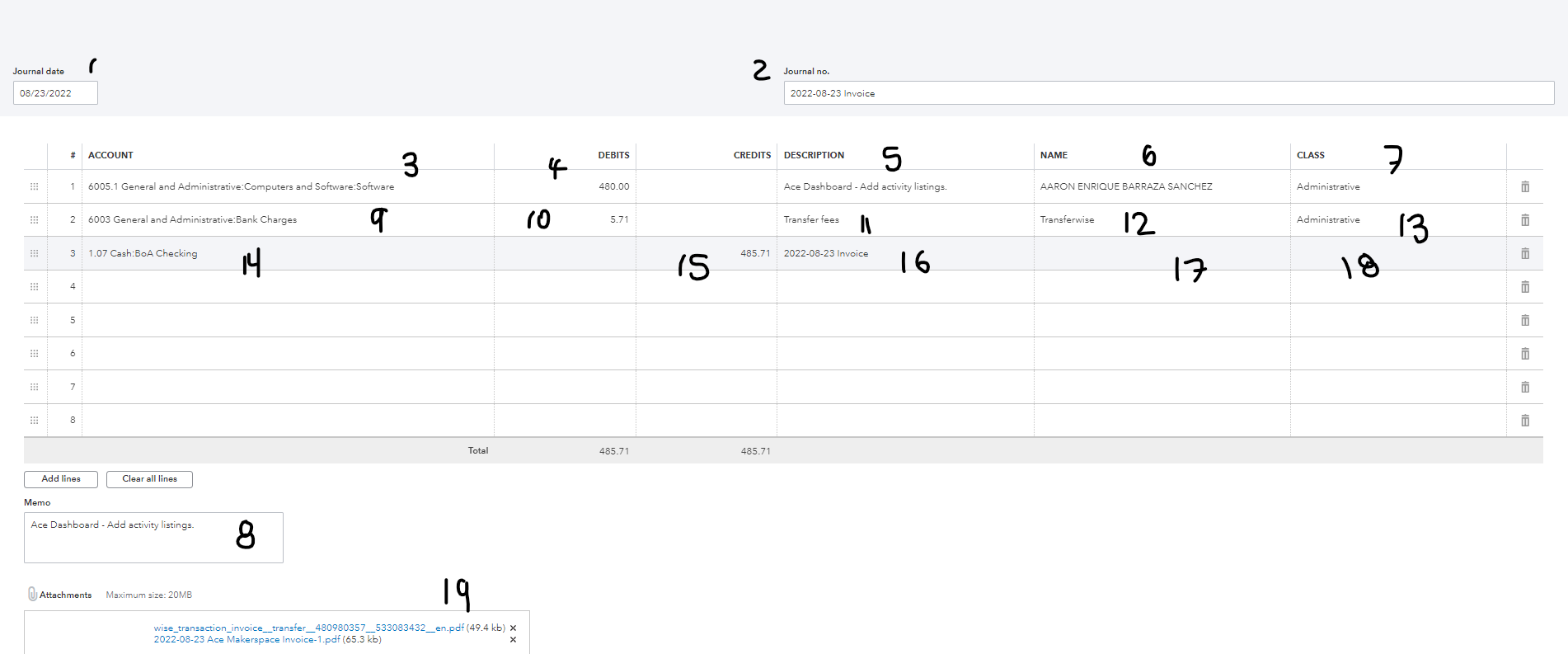

- Once you reach this screen, complete the following fields as follows:

-

- Journal Date- use the date on the bill image or service date. If they are conflicting, choose the earliest.

- Journal no. – journal date in YYYY-MM-DD format followed by the word “Invoice”

- Account (first line) – use guidance from the treasurer’s email to select the correct account code

- Debit Column – record the total bill amount

- Description – use the description from the invoice for the largest line item

- Name – type “Aa” until you can select “AARON ENRIQUE BARRAZA SANCHEZ”

- Class – select Administrative

- Memo – copy the description from the Description above

- Account (next line) – select account 6003 Bank Charges

- Debit Column – record the total fee amount

- Description – “Transfer fees”

- Name – type “Tra” until you can select “Transferwise”

- Class – select Administrative

- Account (last line) – select account 1.07 BoA Checking

- Credit Column – record the total of the transfer fee and Aaron’s fees

- Description – copy from Journal no. (step 2)

- Name – leave blank

- Class – leave blank

- Attachment – add the invoice images here for Aaron and Wise.

- Save and close.